I was helping out at Roseworthy Campus yesterday as the Vet Medicine students were learning about budgeting for a Vet Clinic as a business. One aspect of this was calculating the amount of the cost of goods and services that was GST (stands for “Goods and Services Tax” — in other countries it’s known as VAT or Sales Tax). The Excel sheet they were working in already had the formula worked in and it was this: GST = (Total Price)/11.

This formula is completely correct for GST-applicable items in Australia. In fact, if you google “calculate GST from total in Australia”, the first seven links all show you this exact formula. The problem is, it’s not all that obvious how this formula is related to the GST rate of 10% that we currently have in Australia.

Here is an explanation that worked today when the students asked me.

First, let’s imagine that this rectangle is the original price before the GST was added.

Now let’s add on the GST to get the total amount. Our goal is to figure out what the little blue part is if all we know is the combined amount.

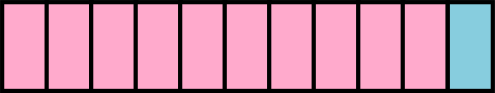

The blue part is 10% of the pink part, so let’s divide the pink part into 10 pieces.

Now there are 11 parts in total and the blue part is one of these 11. That is, it’s an 11th of the combined amount. So if you divide the combined amount by 11 it will tell you the GST.

This made sense to them, so all was well.

Or was it?

Earlier, the lecturer had warned the student that the formula would be different if the GST rate was different, such as if the law changed in Australia in the future or they were in a different country. And it suddenly occurred to me that my explanation wouldn’t be at all useful if the GST rate was something different. It hinges upon some coincidences of our rate of 10% that really just won’t apply to most other rates of GST.

The first coincidence is that the 10% divides evenly into 100%. In the third picture I was able to divide up the pink part evenly into pieces the same size as the GST, and then was able to count the total number of pieces. If the rate was 20%, then I could still do this, and the formula would come out to GST = (Total Price)/6. But if the rate was 15%, then I’d have no hope of using this explanation. Sure, I could figure out how many times 15 goes into 100% (it’s 100/15 = 16 2/3), but there’d be a little leftover bit that would throw out all my whole-number counting.

The second coincidence is that it’s obvious that 10% divides evenly into 100% and it’s obvious how many times it goes. If the rate was 12.5%, then it would go in evenly, but the majority of people wouldn’t know off the top of their heads that it goes 8 times.

So what we really want is not an explanation of our current formula, but a whole new formula and an explanation that goes with it, that will apply to any rate of GST and make it obvious what calculation needs to be done.

And here is the one I came up with in the classroom.

First, let’s consider the original amount before GST was added on.

Now, let’s add on the GST.

The GST is 10% of the original amount, and the original amount is 100% of the original amount, so the combined amount is 110% of the original.

That means the GST as a fraction of the combined amount is 10 out of 110.

So our formula becomes GST = 10/110*(Total cost).

The formula that goes with this for any GST rate is this. If the GST rate is r% and you have the total cost including GST, then the amount of the GST itself is

GST = r/(100+r)*(Total cost)

This explanation and its attendant formula is admittedly more complex than the original, but that complexity allows it to be easily transferred to other situations, which is much better than relying on a couple of coincidences to make it simpler, only to obscure the actual process involved.